unified estate and gift tax credit 2020

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020.

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

The 117 million exemption applies to gifts and estate taxes combinedwhatever exemption you use for gifting will reduce the amount you can use for the estate tax.

. In Revenue Procedure 2021-45 RP-2021-45 irsgov the Internal Revenue Service announced annual inflation-adjusted tax rates for 2022 including provisions concerning estate and gift taxes. A key component of this exclusion is the basic exclusion amount BEA. Unused credit can pass to the surviving spouse if decedent spouse elects on Form 706.

It is a tax credit that decreases the tax bill of the individual or. In other words use it or lose it. For 2021 the estate and gift tax exemption stands at 117 million per person.

Chapter 57 of the Laws of 2010 amended section 951a of the Tax Law in relation to the unified credit for the New York State estate tax. Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. What is the unified credit for estate and gift taxes.

The previous limit for 2020 was 1158 million. This is called the unified credit. The tax is then reduced by the available unified credit.

A married couple can transfer twice that amount to children or others or 228 million without any federal gift and estate tax. For gifts made and estates of decedents dying in 2020 the exclusion amount will be 11580000 per person up from 11400000 in 2019. As of 2021 married couples can exempt 234 million In 2022 couples can exempt 2412 million.

This means that a person can gift during their lifetime or at death up to this amount without implication of an estate or gift tax or some combination of the two. The unified credit against estate and gift. However each person is allowed a unified credit that eliminates the.

That number is used to calculate the size of the credit against estate tax. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. The unified credit is per person but a married couple can combine their exemptions.

Instead all of those funds pass directly to the specified recipients. The unified tax credit is designed to decrease the tax bill of the individual or estate. The federal estate tax gift and estate tax exemption amount is now 114 million indexed for inflation which is an all-time high.

The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed. Gifts and estate transfers that exceed 1206 million are subject to tax. This also includes GSTT gifts generation-skipping transfer tax gifts which are gifts to those more than one.

The Internal Revenue Service recently announced the inflation-adjusted estate and gift tax exclusion amount for 2020. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. News November 29 2021.

The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. It just keeps getting better for wealthy individuals. Any tax due is determined after applying a credit based on an applicable exclusion amount.

The unified tax credit integrates both the gift and estate taxes into one tax system. In other words the unified credit is one pool of credit. 11580000 Generation-skipping transfer tax exclusion.

When an estate is below the unified gift and estate tax credit limit there will be no estate tax due at the time of death. Then there is the exemption for gifts and estate taxes. Prior to the amendment the unified credit referenced the federal Internal Revenue Code.

2020 1 for every additional 3 earned. Non-resident aliens are entitled to a US estate tax unified credit of 13000 which exempts 60000 of property from estate tax. ESTATE AND GIFT TAXES Estate Taxes 2021 2020 Estate tax exemption 11700000 11580000 Unified estate tax credit 4577800 4577800 Top estate tax rate 40 40 Gift Taxes 2021 2020 Lifetime gift tax exemption 11700000 11580000 Annual gift tax exclusion.

A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. Highest estate and gift tax rate. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is.

The estate and gift taxes are based on a series of graduated rates that start at 18. Unified estate and gift tax credit amount. The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law applies the estate tax to any amount above 1158 million.

However the federal estate tax is not currently in effect for 2010 and its status remains uncertain. The federal exemption amount is also now portable between spouses. In other words the donor of a gift is not required to pay any gift tax on the money paid in gift tax.

Gift and Estate Tax Exemptions The Unified Credit. If you made a 1 million gift to a child during your lifetime that would be subtracted from what you could transfer to anyone at death ie under current law that would leave you with 4340000 to transfer to anyone estate and gift tax free. As an overview the unified credit for estate and lifetime gift tax purposes is currently 5340000 per person.

48600 up until first of month of birthday. For 2021 that lifetime exemption amount is 117 million. For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax.

![]()

Factor 2020 Cost Of Living Adjustments Into Your Year End Tax Planning Ds B

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

The Grantor Trust Rules An Exploited Mismatch

Time To Change Your Estate Plan Again

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Build Back Better Estate Tax Planning Impacts

![]()

Factor 2020 Cost Of Living Adjustments Into Your Year End Tax Planning Ds B

Estate And Gift Tax Provisions And Tax Proposals

![]()

The Grantor Trust Rules An Exploited Mismatch

Gift Tax In 2019 How Much Can You Give Before Having To Pay The Motley Fool

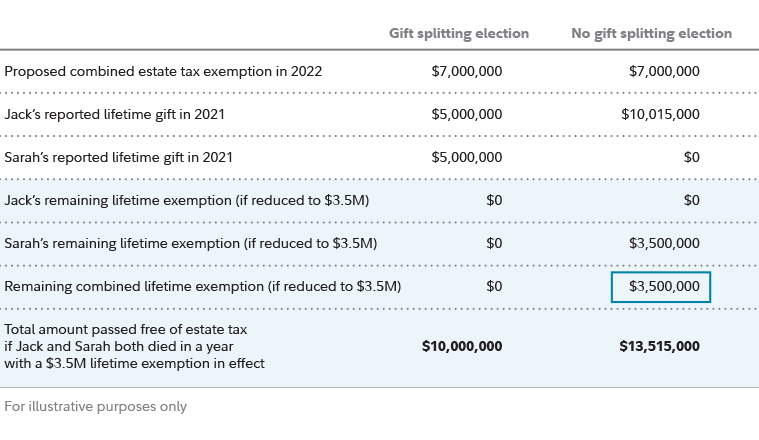

Estate Planning Strategies For Gift Splitting Fidelity

Taxation Of Farmers Ranch Tax Deductions Tax Notes

General Tax Guidelines About Gifting Thestreet

/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)